Bienvenue sur bonus du net

Bonus du net est la destination en ligne de référence pour les passionnés de technologie à la recherche des dernières informations et tendances en matière de technologies de l’information.

Le meilleur de l’IT

Notre site couvre un large spectre de catégories telles que l’actualité, le high-tech, internet, les jeux vidéo, le marketing, le matériel et les smartphones.

Une expérience numérique enrichissante

Que vous cherchiez des insights sur les derniers dispositifs de pointe, des actualités sur les jeux vidéo ou des stratégies marketing, nos contenus sont conçus pour satisfaire votre curiosité technologique et améliorer votre expérience numérique.

Bienvenue sur Bonus du net

Genre : Blog d’entreprise

Notre site vous offre un large éventail de catégories telles que Actu, High Tech, Internet, Jeux-video, Marketing, Matériel et Smartphones.

Services

Nous offrons une variété de services pour répondre à vos besoins de blogging, y compris le développement de sites web, la rédaction de contenu et la promotion en ligne.

Nous couvrons un large éventail de catégories

Notre site propose une variété de contenus informatifs et divertissants pour les passionnés de technologie. Des actualités aux innovations en passant par les dernières tendances, bonus du net est votre source d’information fiable et complète.

Des catégories allant de l’Actu aux Smartphones

Notre contenu conçu pour vous!

Bienvenue sur bonus du net, votre site de référence en matière de technologie de l’information. Notre contenu est spécialement conçu pour répondre à votre curiosité technologique et améliorer votre expérience numérique.

Un aperçu de notre entreprise

Découvrez des articles de qualité

Restez informé sur les dernières tendances en matière de high tech, internet et jeux vidéo grâce à nos articles de qualité.

Explorez les nouveautés et innovations

Nous vous tenons au courant des derniers produits et services informatiques pour améliorer votre expérience digitale.

Enrichissez votre expertise en marketing digital

Apprenez de nos experts sur les stratégies de marketing numérique et les techniques pour atteindre votre public cible.

Faites évoluer votre entreprise

Découvrez les services et fonctionnalités qui peuvent aider votre entreprise à se développer et à prospérer.

Améliorez votre productivité

Des outils et des astuces pour optimiser votre temps et simplifier vos efforts sur le Web et les appareils mobiles.

Élargissez vos compétences professionnelles

Notre contenu vous aide à développer vos compétences en matière de technologie, de marketing et de gestion de l’information.

Restez informé avec bonus du net.

Explorez Notre Galerie de Photos

Découvrez des visuels captivants sur la technologie.

Articles récents

Restez à jour avec notre blog pour des articles pertinents, bien écrits et éducatifs sur le monde de la tech.

Les nouvelles technologies : votre guide vers l’innovation

Les nouvelles technologies façonnent chaque jour notre environnement professionnel et personnel. Elles améliorent la vitesse[…]

Gemeos agency : l’expertise webflow pour un site idéal

Gemeos Agency allie maîtrise technique et créativité pour concevoir des sites Webflow sur-mesure, performants et[…]

Maîtrisez le test en ligne pour le permis de conduire

Maîtriser le test en ligne du permis de conduire facilite une préparation autonome et efficace.[…]

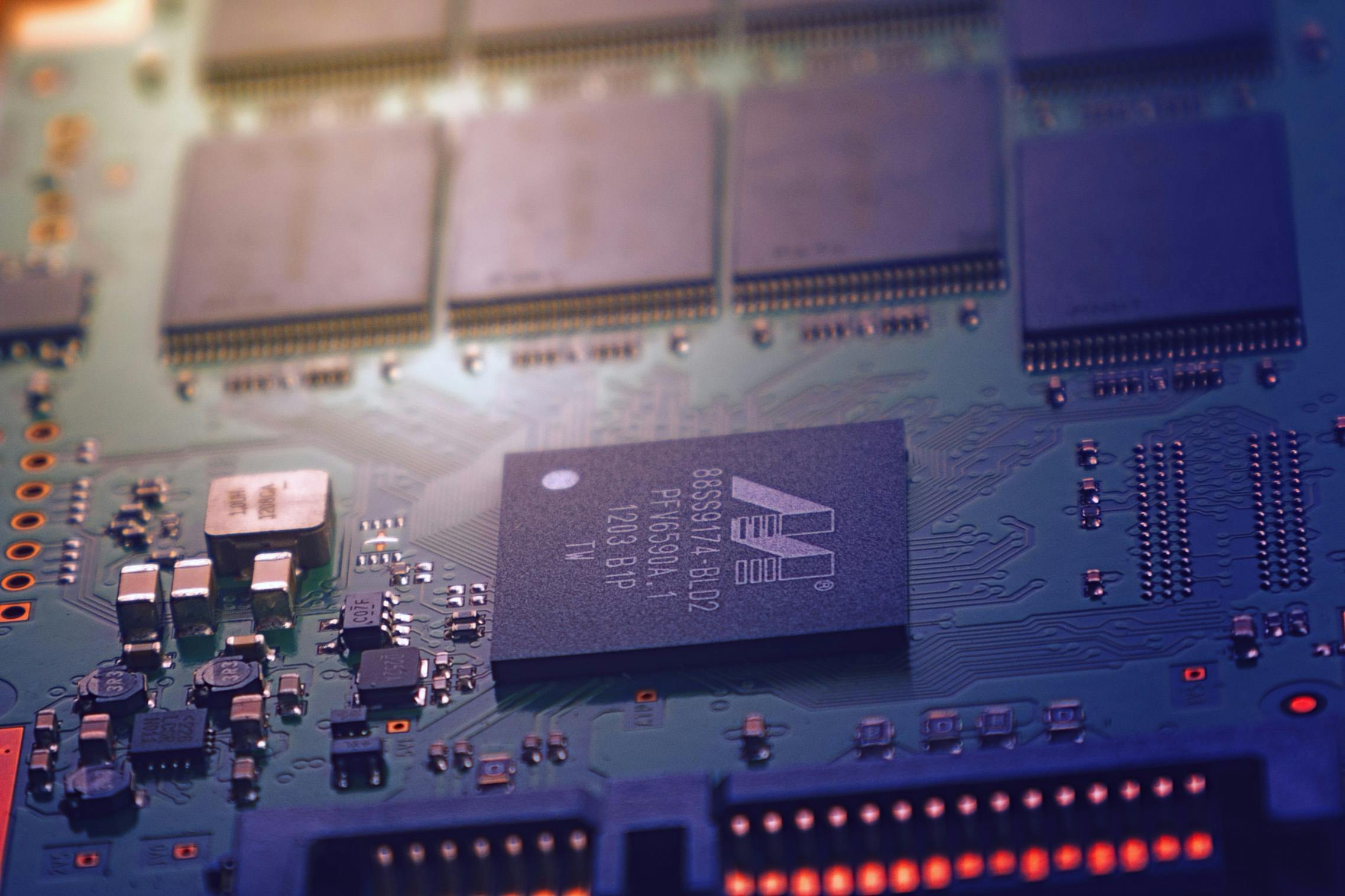

Vente d’électronique industrielle : solutions fiables pour votre maintenance

Trouver des composants électroniques industriels fiables garantit la continuité de vos opérations. Neos Electronic se[…]

Erp pour agence de communication : optimisez gestion et projets

Un ERP adapté aux agences de communication transforme la gestion de projets et le suivi[…]

Analyste cybersécurité : rôle, compétences et carrière à connaître

L’analyste cybersécurité joue un rôle essentiel en protégeant les réseaux informatiques contre les cyberattaques et[…]

Migrer vers shopify : une transition en toute sécurité et réussite

Migrer vers Shopify facilite la transformation digitale en limitant les risques et interruptions. Grâce à[…]

Migrer vers shopify : une transition en toute sécurité et réussite

Migrer vers Shopify facilite la transformation digitale en limitant les risques et interruptions. Grâce à[…]

Choisir la meilleure solution erp pour votre entreprise

Choisir un ERP adapté transforme la gestion de votre entreprise en centralisant finances, logistique et[…]

Isl online : sécurité et efficacité en bureau à distance

ISL Online assure un accès distant sécurisé et performant, simplifiant la gestion des postes et[…]

Optimisez votre contenu pour briller !

Un rédacteur web SEO sait allier rigueur et créativité pour rendre un contenu visible et[…]

Pourquoi choisir une agence de développement mobile pour votre projet ?

Choisir une agence de développement mobile garantit l’expertise nécessaire pour transformer votre idée en application[…]

Où trouver les fréquences radio fm près de chez vous ?

Trouver les fréquences radio FM près de chez vous permet de capter clairement vos stations[…]

Neuf messagerie : vers une expérience sfr modernisée et sécurisée

SFR transforme son service de messagerie avec Neuf, offrant une interface modernisée et sécurisée. Ce[…]

Améliorez la puissance de votre smartphone pour profiter d”une réalité augmentée incroyable !

Optimisation des paramètres de votre smartphone Pour maximiser l’efficacité de la réalité augmentée (AR) sur[…]

Capturez la magie nocturne : optimisez les réglages de votre iphone pour des photos éblouissantes !

Comprendre la photographie nocturne La photographie nocturne fascine par sa capacité à capturer la magie[…]

Sécurisez vos données sur le sony xperia 5 iii : stratégies infaillibles pour améliorer votre confidentialité!

Applications de chiffrement pour renforcer la sécurité Dans le monde numérique actuel, sécuriser ses données[…]

Comment bien choisir son serveur de virtualisation ?

Critères de choix d’un serveur de virtualisation Choisir un serveur de virtualisation requiert une attention[…]

Les problèmes informatiques les plus communs et comment les résoudre

Problèmes informatiques rencontrés fréquemment Les problèmes informatiques peuvent rapidement perturber votre travail quotidien. Parmi les[…]

Relever les Défis de la Sécurité Numérique: Optimisez Votre Stratégie Digitale

Compréhension des Défis de la Sécurité Numérique L’univers de la sécurité numérique est en constante[…]

La virtualisation et l’intelligence artificielle : une combinaison gagnante

Comprendre la virtualisation La virtualisation est une technique qui permet de créer une version virtuelle[…]